If you have business or are planning to launch a business in Indiana, you would need to obtain the Indiana Tax Identification number from the Department of Revenue and meet other formalities.

Apart from the state tax ID number, you would also need to obtain an IRS tax ID (EIN) number to ensure you can file state and federal taxes and run your business smoothly.

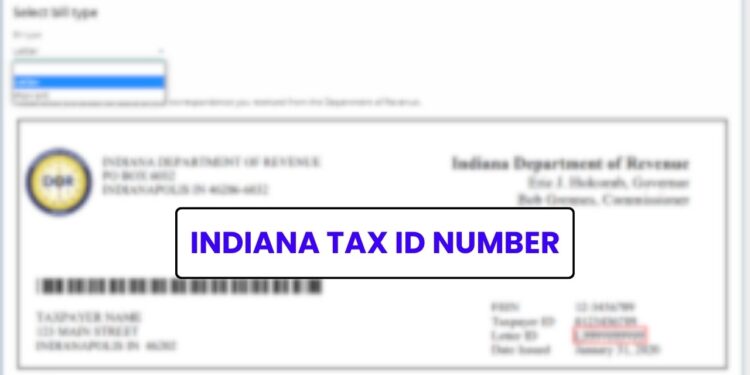

Indiana Tax ID Number

The Indiana Department of Revenue issues the Indian Tax ID number, which is useful for state tax purposes. It is a unique 13-digit number used to identify the assets and business for state taxes and manage the business taxes, such as sales tax, fuel tax, withholding tax, and others.

The business would need the state and federal tax identification numbers for the following purposes:

- Sell taxable goods and services

- Hire staff for the business operation in the state.

- Manage and withhold payroll taxes from the wages

- When you have to manage taxes on alcohol, tobacco taxes, or excise & customs duty.

- Get a business license, register your company, or open a business account with a bank.

The Indiana Department of Revenue enables an online application for the state tax ID number, but before that, you would need to prepare for the application, such as:

- You first need to obtain the IRS Tax ID (EIN- Employer Identification Number), though there may be exceptions for some business structures, such as single-member LLCs or sole proprietorships, etc.

- You will need to complete the online Business Tax Application.

- You should have your business details, legal name, trade name, business structure, responsible party details, and other additional details.

How to obtain an IRS tax ID (EIN) number?

As we said first, you need to have your EIN tax ID with you to apply for the Indiana tax ID number and to get your EIN immediately in 24 hours; the best way is the IRS EIN Assistant, where you can without paying any charges.

So, you can follow the instructions below to file the application for EIN with the IRS:

- Visit the EIN Assistant tool page during weekdays between 7 AM to 10 PM.

- Next, on the dashboard, choose your business structure: LLC, partnership, corporation, or others.

- Next, enter your business names, address, and other details.

- Next, input your ITIN or Social Security number, among other information, as a company’s responsible party.

- To finish the EIN online application, input all the information, check it once, and then click “Submit.”

Important Note:

- Before you apply for the EIN, make sure you have registered your business with the Indiana State authority at the INBiz to legalize your business.

- Remember, your business name follows the federal rules for the EIN registration, and you have all the documents and information for the valid application as only one EIN registration is permissible for a one-time a day to the responsible party.

Steps to apply for Indiana Tax ID Online

Once the IRS reviews your EIN application and finds everything valid, you will get your EIN confirmation and letter with your tax ID number; hence, you can now move to the Indiana Tax ID online application.

To finish the online application for the Indiana Tax ID on the state DOR, follow these steps:

- Go to the Indiana Department of Revenue and search for the State ID number application.

- You must have registered your business at the INBiz portal to operate your business as a legal entity.

- Next, initiate the tax ID application by clicking the Business Tax Account.

- You now need to enter your contact information, SSN/ITIN, and business data.

- Next, enter your federal Employer Identification number and other details.

- Afterwards, review your entered details and complete the Indiana state tax ID number application.

When can you expect your Tax ID number after the application?

When you complete your Indiana tax ID application online through the official portal, you can expect the department to issue your 13-digit tax ID number within a few hours of the application.

If you have any issues regarding your Indiana tax ID application or obtaining your business tax ID, you can contact the agency at 317-233-4016. When you complete the Indiana tax ID number, you should register your business on the Employer Self-Service Portal.

When you plan to launch the business in Indiana, you must remember to file with the respective department to run your business smoothly. First, you should register your business, and if our business requires you to get an EIN and then obtain the state tax ID for tax purposes.