Is your business in need of a tax ID number? If you’ve recently started a business in Louisiana, you’ll probably end up needing one. Fortunately, the process for obtaining a tax ID number is simple and quick (if you’re doing it online).Most business entities, like LLCs and corporations, will need a tax ID, also known as an EIN, to operate legally. In this guide, you’ll learn what conditions...

Indiana Tax ID Online Application | How to Apply for a Tax ID (EIN) Online

Looking to apply for a tax ID (EIN) for your Indiana business? Like most business owners, you probably need a tax ID for your business. There are many types ofbusiness entities you could create, including corporations, nonprofits, limited liability companies (LLCs), and more, and most of these will require a tax ID by default. Knowing the best way to apply for a tax ID can save you time, reduce...

Choosing a business structure

Your business structure affects how much you pay in taxes, your ability to raise money, the paperwork you need to file, and your personal liability.You’ll need to choose a business structure before you register your business with the state. Most businesses will also need to get a tax ID number and file for the appropriate licenses and permits. Choose carefully. While you may convert to a...

Obtain a Tax ID (EIN) Number and Register Your Business in North Carolina

Whether you’re starting a business as a way to build wealth, a way to leave behind a legacy, or just to have more control over your hours and work, you’ll need to spend some time legally establishing your business before you begin full operations. North Carolina is a great place to get started- but you need to be aware of the requirements before you get too far in the process. Ready to start your...

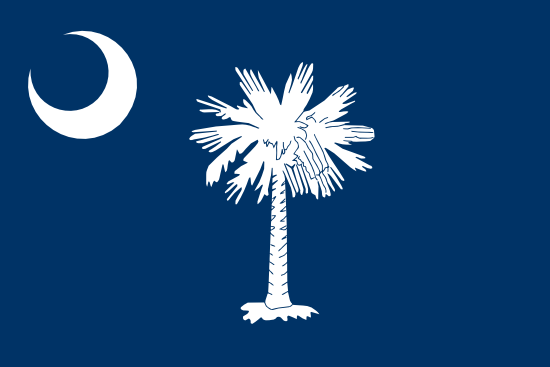

Obtain a Tax ID (EIN) Number and Register Your Business in South Carolina

On paper, your business idea may seem brilliant, but it isn’t worth much unless it’s put into action. Before you can start expanding your market in South Carolina and reaping profits, you need to jump through a few legal and regulatory hoops. This guide will help you understand exactly what you need- and how to obtain it. Looking just for the Tax ID (EIN) Application? Apply for a Tax ID (EIN)...

Obtain a Tax ID (EIN) Number and Register Your Business in Wisconsin

Starting a business in Wisconsin takes significant effort, but it could set you up for the career of your dreams. If you have a solid idea for a business, or experience in a management role, you could potentially get started in the span of a few weeks- all you need is a business plan, and the necessary registration to get started. Ready to start your Tax ID Application Now? Apply for a Tax ID...

Apply for Trust Tax ID (EIN) Number | Online EIN Application

When you create a trust, you create a separate entity that is intended to reduce taxes and control assets. Of course, creating a separate entity can also mean that you need a separate Tax ID number. Whether you’re trying to create a trust account for someone else or you’re managing an estate trust for someone who has passed, finding out more about the EIN process is critical. Here’s everything...

Apply for Tax ID (EIN) Number for a Sole Proprietorship | Online EIN Application

The simplest and most common business structure, a sole proprietorship refers to an unincorporated business run by a single individual. When you run a sole proprietorship, you report your business income as personal income and you get taxed accordingly. In contrast, with a corporation, the business pays you salary or dividends which you report as your personal income, and the business reports its...

Apply for Tax ID (EIN) Number for a Partnership | Online EIN Application

Does your partnership need a tax ID number? Can you apply for a tax ID number for a partnership online? For both partnerships and corporations, a tax ID number will usually be used to separate the business into a separate tax-paying entity. Here’s what you need to know. Ready to start your Tax ID Application Now? Apply for an IRS Tax ID Number Steps to Getting a Tax ID (EIN) Number for a...

Apply for Tax ID (EIN) Number for a Non-Profit Organization | Online EIN Application

As a non-profit organization, compliance with Internal Revenue Service requirements is paramount. To be seen as a positive non-profit, one that is in good standing with the IRS, you need a Tax ID (EIN) Number for tax administration purposes. Ready to apply already? Apply for a Non-Profit Tax ID (EIN) Number Steps to Applying for Tax ID (EIN) Number for a Non-Profit Organization Prepare Mandatory...