For millions of Minnesota residents, starting a business and becoming an entrepreneur is a dream. With practically unlimited scheduling flexibility and an opportunity to build long-term wealth, there are few career opportunities as enticing. But before you can start generating revenue, you need to choose your business structure and get your tax ID numbers. Minnesota is home to more than 513,000...

Obtain a Tax ID (EIN) Number and Register Your Business in Oregon

Oregon has experienced incredible economic growth over the past 20 years. Between 1997 and 2015, the state’s inflation-adjusted gross state product (GSP) has grown from $112 billion to $201 billion, despite two recessions that may have otherwise interrupted that growth period. Oregon’s economy shows no signs of stopping anytime soon, making it a hotbed of activity for new and experienced...

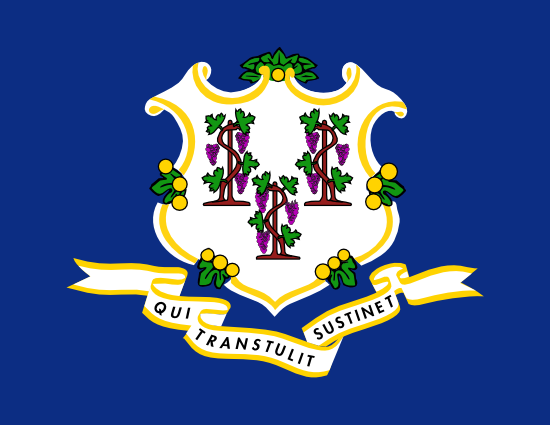

Obtain a Tax ID (EIN) Number and Register Your Business in Connecticut

Thanks to the plethora of resources available to aspiring entrepreneurs, it’s easier than ever to start a business in Connecticut. However, there are still some steps you’ll need to go through before your business can begin legal operations. Connecting several states in the northeast, Connecticut could be an ideal area in which to start your business. There are several major hubs for small...

Obtain a Tax ID (EIN) Number and Register Your Business in Missouri

When you have a strong business idea and a conviction to get it moving in the state of Missouri, it seems like nothing can stand in your way. However, before you get established and start making money, it’s important for you to choose the right business structure and register your business at both the federal and state level. Missouri Means Business Missouri is a friendly and welcoming state to...

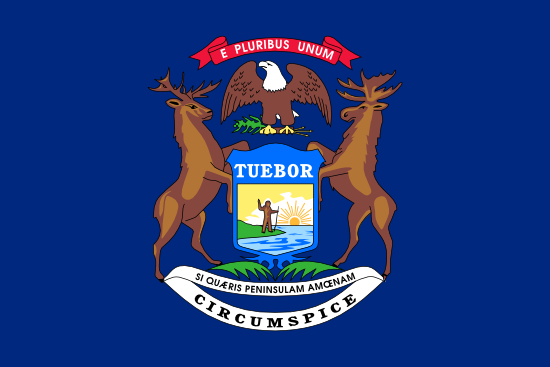

Obtain a Tax ID (EIN) Number and Register Your Business in Michigan

Whether you’re looking at the northern or southern peninsula of Michigan, there are many vibrant cities for entrepreneurs to call home. But before you pack your bags and move, or start scouting locations in your home state, you should know what it takes to make your business official in the Wolverine state. Michigan Means Business If you’re a first-time business owner, you’ll be hard-pressed to...

Does a Trust Need a Tax ID Number?

Whether a trust needs a tax ID number depends on the type of trust. A trust account that is “revocable” is still an account that can be controlled by the original grantor of the trust. Consequently, it’s going to be filed under the grantor’s own social security number or individual taxpayer identification number. If the trust is irrevocable, on the other hand, it’s a...

What is an Irrevocable Trust? | IRS Definition of a Trust

An irrevocable trust is a special type of account that holds assets that are given by a grantor. The trust account will hold these assets either indefinitely or under specific terms set out in the trust, generally to the benefit of a specific beneficiary such as a relative or a charity. The trust account is an entirely separate entity to the grantor and the beneficiary, and consequently requires...

What is a Revocable Trust? | IRS Definition of a Trust

A revocable trust is a trust that is created under an agreement that can be changed. When opening the trust, a grantor (or grantors) will place assets in the trust for the benefits of a beneficiary. The trust will pay out under terms that the grantor has stated and the beneficiary only has the amount of control over the trust that the grantor grants. At any time, the trust can be dissolved by the...

Does a Trust Need a Tax ID (EIN)?

Trust accounts are designed to transfer wealth from a grantor to a beneficiary. There are many types of trust. Whether a trust needs a tax ID depends on the type of trust it is. A revocable, living trust remains under control of the grantor of the trust, and because of this it doesn’t need a tax ID. Instead, the trust will use the same tax ID as the grantor. On the other hand, if the trust...

Single-Member LLC vs Multi-Member LLC | What is the Difference?

Short for limited liability company, an LLC is a legal business structure, established by state laws. If you’re on your own, you can start a single-member LLC, but if you have partners, you need a multi-member LLC. These two options offer a range of different pros and cons. Keep in mind that not all types of LLCs need to obtain a Tax ID Number. To help you decide between a single and multi...