When you run a restaurant, you’re busy writing menus, perfecting dishes, supervising staff, keeping customers happy, and juggling countless other tasks. On top of that long to-do list, you also have to manage your restaurant’s tax and banking needs, and generally, you need a tax ID called an Employer Identification Number (EIN) to handle everything. Wondering what is a tax ID (EIN)...

Louisiana Tax ID Online Application | How to Apply for a Tax ID (EIN) Online

Is your business in need of a tax ID number? If you’ve recently started a business in Louisiana, you’ll probably end up needing one. Fortunately, the process for obtaining a tax ID number is simple and quick (if you’re doing it online).Most business entities, like LLCs and corporations, will need a tax ID, also known as an EIN, to operate legally. In this guide, you’ll learn what conditions...

Indiana Tax ID Online Application | How to Apply for a Tax ID (EIN) Online

Looking to apply for a tax ID (EIN) for your Indiana business? Like most business owners, you probably need a tax ID for your business. There are many types ofbusiness entities you could create, including corporations, nonprofits, limited liability companies (LLCs), and more, and most of these will require a tax ID by default. Knowing the best way to apply for a tax ID can save you time, reduce...

15 Ways to Grow Your Business Fast

Let’s face it. Scaling your business is hard. It takes considerable effort. In the beginning, it means wearing different hats. It means dealing with sales and marketing. It means understanding taxes and corporate compliance. It involves having to interact with customers on a daily basis. And so much more. At the end of the day, it takes its toll on you.If you’re struggling to grow...

Choosing a business structure

Your business structure affects how much you pay in taxes, your ability to raise money, the paperwork you need to file, and your personal liability.You’ll need to choose a business structure before you register your business with the state. Most businesses will also need to get a tax ID number and file for the appropriate licenses and permits. Choose carefully. While you may convert to a...

Business Startup Checklist

When you’re starting a business, there are seemingly endless things to do and a myriad of hats to wear. From branding strategy to tech tasks to legal hurdles, the things to check of your starting a business checklist can seem like they require a whole team of multi-faceted talent. Even if you’re in it alone—as many new business owners often are, starting a business isn’t an impossible feat...

Obtain a Tax ID (EIN) Number and Register Your Business in North Carolina

Whether you’re starting a business as a way to build wealth, a way to leave behind a legacy, or just to have more control over your hours and work, you’ll need to spend some time legally establishing your business before you begin full operations. North Carolina is a great place to get started- but you need to be aware of the requirements before you get too far in the process. Ready to start your...

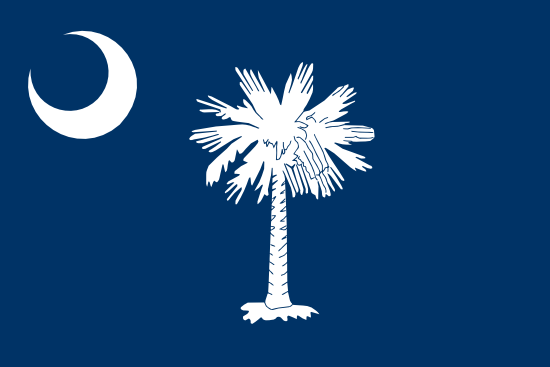

Obtain a Tax ID (EIN) Number and Register Your Business in South Carolina

On paper, your business idea may seem brilliant, but it isn’t worth much unless it’s put into action. Before you can start expanding your market in South Carolina and reaping profits, you need to jump through a few legal and regulatory hoops. This guide will help you understand exactly what you need- and how to obtain it. Looking just for the Tax ID (EIN) Application? Apply for a Tax ID (EIN)...

Obtain a Tax ID (EIN) Number and Register Your Business in Wisconsin

Starting a business in Wisconsin takes significant effort, but it could set you up for the career of your dreams. If you have a solid idea for a business, or experience in a management role, you could potentially get started in the span of a few weeks- all you need is a business plan, and the necessary registration to get started. Ready to start your Tax ID Application Now? Apply for a Tax ID...

Apply for Trust Tax ID (EIN) Number | Online EIN Application

When you create a trust, you create a separate entity that is intended to reduce taxes and control assets. Of course, creating a separate entity can also mean that you need a separate Tax ID number. Whether you’re trying to create a trust account for someone else or you’re managing an estate trust for someone who has passed, finding out more about the EIN process is critical. Here’s everything...